Do you have a summer job to offer?

Announce your summer job voucher vacancy by filling in the form behind the link. The City of Oulu summer job voucher can be used for employment by companies, associations, societies, organisations, clubs, or foundations in the Oulu region (Oulu, Hailuoto, Ii, Kempele, Liminka, Lumijoki, Muhos, and Tyrnävä).

Summer job voucher subsidy

Dear employer, the basic salary of 370 euros mentioned in previous City of Oulu instructions for the summer job voucher has been annulled. The employer must pay the young employee according to the collective labour agreement or a generally binding labour agreement. More specific instructions can be found under the title ”Fair compensation for summer employment”.

You can use the summer job voucher to hire a 15 – 17-year-old person (born 1 May 2006 – 30 April 2009) to work in the summer season 1 May – 30 September 2024. A young person may use one summer job voucher during the summer, and the voucher is for personal use only.

We subsidise employers for 330 euros of a summer voucher employee’s salary. The subsidy will be paid to the employer after the employment. The application must be submitted through eAsiointi online service by 31 October 2024.

The summer job voucher employment lasts for two weeks and includes 30 hours of work per week or a total of 60 hours during the summer season. If the total number of hours is less than 60, the summer job voucher compensation will be paid according to the actual work hours.

The summer job voucher can be used for employment by companies and third sector bodies operating in Oulu, Hailuoto, Ii, Kempele, Liminka, Lumijoki, Muhos, or Tyrnävä.

A private person cannot hire a summer employee with the voucher subsidy. The employer must have a company ID.

A summer job voucher cannot be used simultaneously with other summer job models directed to youth (e.g. 'Tutustu työelämään ja tienaa' model).

Fair compensation for summer employment

The employer must pay the young summer employee according to the collective labour agreement or a generally binding labour agreement.

If the employer is a member of a trade union that has signed a labour agreement, they must abide by the salary regulations of the labour agreement based on their membership. Otherwise the young employee must be paid a normal and fair salary so that the minimum wage regulated in the employment conditions of the Unemployment Security Act is met. (Employment Contracts Act, Section 2, Article 10) Also the amount of salary regulated in the employment conditions of the Unemployment Security Act (Section 5, Article 4, Subsection 3, 1290/2022) can be considered when estimating a normal and fair salary. If there is no relevant collective agreement, the wage must amount to at least EUR 1,399 per month in 2024. See further instructions here.

In addition to the basic salary, the summer employee must be compensated for vacation days and also observe possible evening and weekend allowances. For more specific instructions, please consult the labour agreement of your field and the generally binding labour agreement.

If the young person is not entitled to vacation compensation, please complement the application with a duty schedule showing the days and hours of work. The realised work hours done by the employee must be marked in the application.

The young employee must be provided with a duty schedule for as long a period as possible, and in no circumstances for no less than a week. The employees have to be informed of the work schedule in writing well in advance, and no later than one week before the period signified in the schedule. After this, the work schedule may be changed only with the consent of the employee or for a significant reason related to the organisation of work. (Working Hours Act, Section 7, Article 30)

Please see to it that the young employee is sufficiently initiated into the tasks of their work and that they have a contact person at the place of work to whom to turn to with work issues.

The law on young employees must be observed for the summer employment.

An excess share will fall to the employer in the salary expenses. In addition, the employer will pay the statutory side expenses for the salary.

Apply for the subsidy at eAsiointi

Please apply for the summer job voucher subsidy through the eAsiointi online service. Use of the service requires strong electronic identification and authorisation for doing business on behalf of a company ID. Accepted forms of authorisation include a general signature right or more specifically an authorisation item entitled ”Submitting a subsidy application” for which there are separate instructions. You can find more information about authorisations from this link (in Finnish). You will need the data of the company and the young employee from the filled-in summer job voucher. A job contract and verification of salary payment shall be included as attachments. You can enter the eAsiointi service from this link.

If you are unable to access eAsiointi, please make sure that your network connection is sufficient. Refreshing the page is often helpful. You can also try accessing the page on a different browser (Google Chrome, Firefox, Edge). At times, the F-Secure virus protection software may prevent access to eAsiointi after strong authentication. The problem can be solved by adding the eAsiointi website address as an allowed site on F-Secure. If none of these measures help, you can contact kesatyo(at)businessoulu.com. Once you have submitted an application via eAsiointi, the system will send you notifications about the progress of your application to the e-mail address you provided. Please, also remember to check your junk mail folder for these messages, if necessary.

The City of Oulu supervises its necessary obligations according to the Act on the Contractor’s Liability also when granting and paying benefits and subsidies. If the applicant does not belong to the advance collection register, the recipient of the subsidy must be able to verify the fulfilment of required obligations, if requested. See complete instructions at vero.fi service.

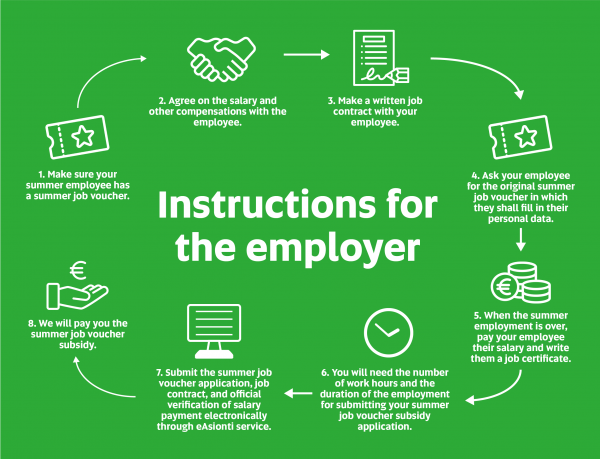

How to proceed

- When you have found a suitable summer employee, make sure that they have a summer job voucher issued by the City of Oulu, their place of residence is Oulu and they are the right age to use the summer job voucher (born 1 May 2006 – 30 April 2009).

- Agree on the pay with your young employee before work starts. The basic salary must adhere to the collective labour agreement or a generally binding labour agreement. Otherwise the employee must be paid a normal and fair salary so that the minimum wage regulated in the employment conditions of the Unemployment Security Act is met. In addition to the basic salary, the summer employee must be compensated for vacation days, and possible evening and weekend allowances must also be observed.

- Make a written agreement with your employee, stating the start and end dates of the employment, the number of hours, the tasks to do, and a salary adhering to the collective labour agreement or a generally binding labour agreement. Please note that the employment contract must not be altered afterwards without the employee’s consent. When it comes to insuring your employee for occupational accidents, consult your insurance company.

- Ask your employee for the original summer job voucher in which they shall fill in their personal data.

- When the summer employment is over, pay your employee their salary immediately. Remember also to write them a job certificate for the summer employment.

- Ask your young employee and their guardian for their consent to hand over their information to BusinessOulu employment services (EU General Data Protection Regulation). You do not have to deliver the form to the City of Oulu, for it is a contract between the employer and the employee, and the employer shall have a copy.

- When you have paid your employee their salary, log in to the eAsiointi service and do as follows:

- fill in the electronic summer job voucher application (information from the voucher sheet) and attach the following appendices:

-

- signed job contract

- official verification of salary payment, stating the employee’s name, identity number, basic salary and the employer payments paid. The last salary receipt will do if it shows the total salary paid during the summer and the work hours done. You can use services such as the Palkka.fi page to pay the salary and print out a salary receipt by logging in to the service. The salary must be paid to a bank account appointed by the employee. Paying in cash is unacceptable. Self-made receipts or cash ones are not acceptable verifications for salary payments. If requested, the subsidy recipient must be able to verify the fulfilment of required obligations.

- We will pay a summer job voucher subsidy of 330 euros at the most, based on the application and appendices. The application and appendices must be submitted by 31 October 2024 through the electronic eAsiointi service. Please check that the submission of the application is completed. The system will send an automatic confirmation to the e-mail address which you have submitted once the application has been received. You can also check the status of the application on the OmaAsiointi tab of the eAsiointi online service. Please do not hesitate to contact kesatyo(a)businessoulu.com, if you have any questions about the application process.

Please, also note that the summer job voucher subsidy will not be paid if the summer employee has been paid a salary that does not meet the summer job voucher terms, documentation is lacking, or it has not been submitted in time. The City of Oulu cannot be invoiced for the summer job voucher transaction.

Employer payments

If requested, the subsidy recipient must be able to verify the fulfilment of required obligations. For a complete set of instructions on the employer payments, please go to vero.fi.

Important links

- eAsiointi (only in Finnish)

-

Instructions for acquiring suomi.fi authorisation (only in Finnish)

- Employer's checklist (Regional State Administrative Agency)

- Palkka.fi salary calculator (only in Finnish and Swedish)

- What must a pay slip show?

- Employees social insurance payments 2024

- Paying a salary via palkka.fi service (only in Finnish and Swedish)

- Declare the salaries you have paid to the income register

- Job contract form

- Job certificate form

- Act on young employees

- Occupational safety and health, young employees

- Government act – young employees and specific harmful and hazardous work (only in Finnish)

- Work hazardous for a young employee must be declared - Occupational safety and health bulletin 3/2021

- Under 18-year-olds and mowing the lawn (only in Finnish)

- Alcohol passport - Valvira

- Collective labour agreements (only in Finnish)

- More information about preliminary tax withholding register and applying for inclusion